- AT&T is seeing an uptick in late payments, the company said in its recent earnings call.

- This is yet another example of how inflation is increasingly weighing on US consumers.

- While consumer spending and the job market are still strong, other signs point to a slowing economy.

If you can't afford to pay your phone bill on time, there's a good chance you're also struggling to pay for groceries, gas, rent and credit card balances. It's not a good look for the future of the economy.

This is what AT&T is seeing from many of its customers, the company said during its quarterly earnings call last Thursday.

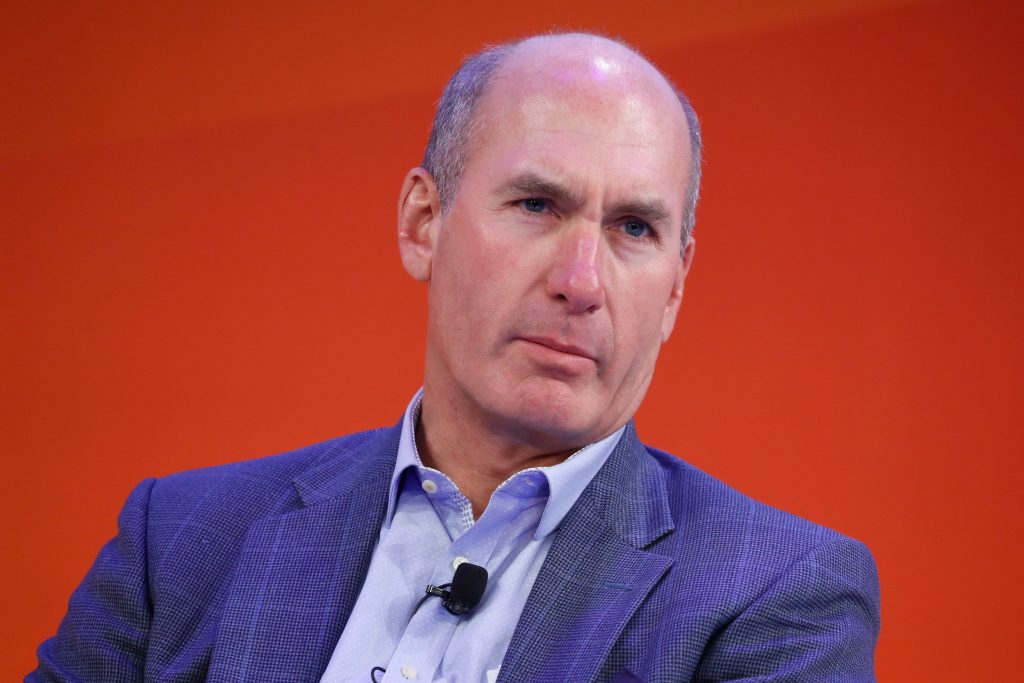

"On the consumer side of our business, we're seeing an increase in bad debt to slightly higher than pre-pandemic levels, as well as extended cash collection cycles," said AT&T CEO John Stankey, alluding to an uptick in late payments the company is seeing from consumers.

The late payments are among the growing signs that the US economy could be slowing. Though spending remains quite strong overall, inflation-adjusted personal consumption expenditures fell 0.1% in May. Last Thursday, initial jobless claims — a proxy for layoffs — rose to its highest level since last November. Consumer confidence remains near record lows, and Thursday's GDP report is expected to show a decline for the second consecutive quarter — which is an outdated, albeit important signal that the country could be in a recession. Given consumer spending accounts for roughly two-thirds of US economic activity, economists are on the lookout for any signs of deterioration. Late phone bills could be one.

While the elevated costs of gas, food, and housing have surely contributed to the cash crunch driving late payments, cell phone services have gotten more expensive as well. In May, AT&T raised prices on some of its older wireless plans by as much as $6 per month for single-line users and up to $12 per month for families. Only a few weeks later, its competitor Verizon raised prices as well. AT&T's price hike was partially driven by the inflationary pressures the company is experiencing. In April, the company said "inflation and rising wages" had added at least $1 billion in additional costs. While competitors might offer a cheaper phone bill for some consumers, the hassle of switching might deter many from doing so.

But it's not all bad news for the over 90% of Americans that own a cell phone.

Over the last 20 years, as the costs of healthcare, college, and childcare have risen well above the rate of inflation, cell phone services have gotten more affordable in the grand scheme of the industry. Additionally, as of June, smartphone prices had fallen 20% over the last year. As consumers have shifted their spending from goods to services, companies have been straddled with bloated inventories — which has led some to cut prices.

With inflation near record-highs, the Federal Reserve is raising rates in an effort to slow the economy and bring costs down. The price cuts associated with the elevated inventories of companies like Walmart and others could help the central bank reach its desired "soft landing". But if the economy teeters into a recession, AT&T's late payments could be an early signal that consumers — many of whom have drawn down their savings in recent months — will struggle.